Doak improvement project takes another step towards approval

The Doak Campbell Stadium renovation project took another step forward on Wednesday when the Finance and Business Committee of the Florida State Board of Trustees reviewed and approved the FSUAA debt financing plan for the project, which was first discussed in 2021. The project will be presented to the full Board of Trustees for approval on Oct. 27, the Board of Governors on Nov. 9 before going to the Governor and his Cabinet.

Senior Vice President for Finance & Administration Kyle Clark led the presentation to the committee, which reviewed the project scope, goals and debt financing plan. He was joined by FSU Vice President and Athletic Director Michael Alford and Seminole Booster President and CEO Steven Ponder.

“We have been working very closely with the Division of Bond Finance and with the Florida Board of Governors,” Clark said. “We’ve also worked very closely with the University Bond Counsel and with our tax counsel to review the opportunity.”

Clark then reviewed the project timeline, which listed more than two dozen updates between February 2021 and Wednesday’s meeting with either the Seminole Booster Board, FSUAA, Board of ,Trustees or BOT Finance and Business Committee. “The importance of this is we want the board to understand we haven’t made any decisions in a vacuum,” Clark said. “We’ve worked hard to try to communicate and share the vision and make sure the board has been involved every step of the way.

“The last update was shared on September 8 at the BOT meeting. We also shared the information with the Finance and Business Committee and brought in the outside consultant who helped us develop not only the proforma but also put together many of the assumptions that were used, and the estimates that helped develop the opportunity we are going to be discussing today.

“In terms of the future, the FSUAA (Florida State University Athletic Association) will be meeting next week to approve the project. The Boosters are working on the joint venture agreement between Manhattan and Culpepper (Contractors). They anticipate that the agreement may be executed as early as today.

“On November 8 and 9, the Board of Governors meet and will hear this project, if our BOT approves it on October 27. And on December 12, the Governor and his Cabinet will be final step should the project move forward.”

If approved, the massive project is expected to be completed in August 2025 in time for the home opening game against Alabama.

Overall project goals

· Maximize attendance and participation

· Maximize amenities and comfort

· Maximize donor and customer experience

· Design stadium to respond to current and future opportunities

· Address football operational needs

· Activate stadium beyond football

· Identify and maximize untapped revenue streams

· Increase net operating income

· Mitigate financial risk

Alford reviewed the project goals with the committee, which he noted were put together with the assistance of global sports consultant CSL.

The project goals address the game day amenities and comfort level of fans attending home games including a variety of options. In addition, the goal is to activate the stadium more frequently to uncover hidden revenues to help mitigate financial risk.

“As you know we have seven home games a year,” Alford said. “But really, we want to look at this stadium more than that. Whether it’s concerts … motocross … various events throughout the year we will be able to utilize the stadium for revenue opportunities.”

Project scope

The project will entail a renovation of the west side of Doak Campbell Stadium as well as the south end zone Dunlap Champions Club.

“We will complete the west side renovation of the stadium by adding premium seating at the lower midfield, chair backing part of the west side, with new concourses, concessions, bathrooms and social spaces,” Alford said. “We are also looking to renovate the south end zone by adding eight different premium experiences in its current footprint. Right now we have just one, the club seats. This is going to offer eight different premium experiences, with eight price points, more variety for our constituents in that end zone.”

Seminole Boosters president and CEO Stephen Ponder described the west side enhancements, starting with new bleacher seating, which will go from the goal line to the back of the end zone. “These bleacher seats will have an increased tread depth to 33-inches (currently 27) that require no capital gift,” Ponder said.

From goal line to goal line, there will be chairback seating in the rows above the club seats, loge seats and mid-level sky boxes.

“As for the field club on the 50-yard line, there’s roughly 2,200 (club) seats associated with that club. Right behind (the club seats) there’s 28 Founders Loge boxes and then we have eight Founders Suites, so we have five or six options right there with different experiences with different affordability options to enjoy the game. But, as Michael said, the concourses, concessions and restrooms are getting improved on the entire west side in this process.”

Ponder also provided a sales update, noting sales are ahead of pace.

“We are selling it based on products,” Ponder began. “We sold all eight Founders Suites. We sold the 28 Founders Loge Boxes. Of those 2,200 club seats, we are 51 percent sold in the club. We have appointments every day. Last Friday we had 28 appointments either through the preview center or on Zoom. Every day our staff is meeting with another group of season ticket holders or Booster members.”

Financing the project

The next portion of the presentation on financing was run by Clark, who began by reminding the committee that most of the information to be presented was the same as discussed in previous briefings with board members.

Clark noted that the University has been working with the State of Florida Division of Bond Finance (DBF) on structuring the new debt. He reported that DBF is working with FSU’s outside bond counsel to determine the amount of debt that can be tax-exempt financed. He noted that to be conservative the University’s request assumes 100 percent taxable financing.

“Right now, the current proforma has been built around 100 percent taxable financing,” Clark said. “The proposed term includes borrowing up to $265 million at 7 percent over 30 years. These are very, very conservative estimates. We hope to not have to borrow $265 million. That will depend on the tax opinion at the time of issuance. We obviously hope we won’t have to pay 7 percent interest but that will depend on the market conditions at the time.”

The bonds will be structured with two components. An accelerated piece totaling $17.32 million based on estimated receipt of private gifts and donations over the next five years, with annual debt service ranging from $6.18 million in year one to $1.71 million in year five.

Clark reported that there would be a $247.68 million level debt service over 30 years with a $20.29 million annual debt service.

Committee member Jorge Gonzales presented the proposed sources and uses of funds for the bond issuance, which was presented to the Board of Governors more than a month ago.

Trustee Gonzales reiterated Clark’s opinion on the estimated amount needed to complete the project of $265 million being conservative. He also noted the Donations on Hand is currently over $9 million. The investment earnings are estimated at a conservative 2% when short-term interest rates are considerably higher.

Revenue bonds

| Bond par amount | $265,000,000 |

|---|---|

|

Donations on hand |

$8,019,593 |

|

Investment earnings on project fund |

$4,923,113 |

|

Total source of funds |

$277,942,706 |

| Project cost | $233,305,705 |

|---|---|

|

Capitalized interest |

$30,340,187 |

|

Underwriter's discount |

$5,300,000 |

|

Cost of issuance |

$301,023 |

|

Bond contingency |

$8,695,791 |

|

Total uses of funds |

$277,942,706 |

The project cost of $233 million includes $25 million contingencies. Again, the underwriter’s discount is based on a conservative estimate of 2 percent, which they expect to come in lower. The bond contingency is also a conservative figure and is separate and apart from the project contingencies.

Debt service coverage

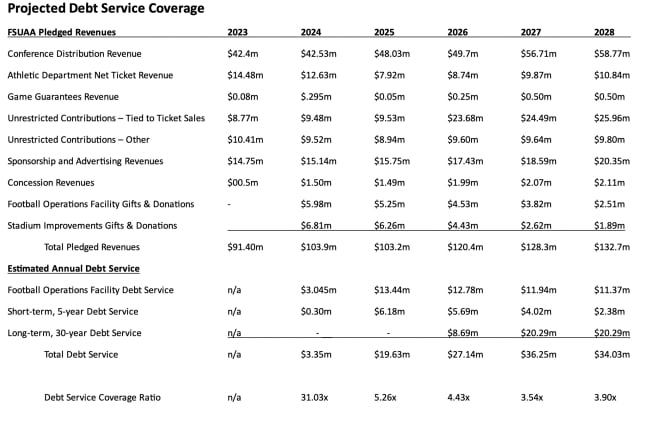

Trustee Gonzales then reviewed the Debt Service Coverage Table illustrated above which will be presented to the Board of Governors. It illustrates the pledged revenues that will be used to secure the debt on the football stadium and the football operations building.

“As you’ll see on the bottom line, our coverage is robust and substantially greater than the required BOG coverage of 1.2 (times the debt service),” Gonzales said.

Trustee Gonzales noted that the short-term debt service could be more as more product is sold, which would lower the long-term debt piece.

“The pledged revenues do not include revenues athletics receives but cannot be pledged to debt, such as student-athletic fees and certain restricted coaches’ club contributions as well as certain revenue streams that are pledged to the outstanding FSU Financial Assistance Inc. debt. However, with those revenue streams, we are planning on pledging them after we are able to refund all the outstanding FSU Financial Assistance Inc. debt.”

The Financial Assistance Inc. debt included existing debt on Doak Campell Stadium.

Following Gonzales’ presentation, Clark pointed out that the football operations facility debt service is included as part of this debt service. “We wanted to be sure we are including all of the estimated expense, so you can see we are at a 31x coverage at a peak and the worst case is a 3.5,” Clark said. “The Board of Governors mandate a 1.2 so we are almost triple that in every scenario.”

Timing of approvals, construction

Clark said pending approvals, construction will begin right after the final home game is played against North Alabama on Nov. 18.

There’s a gap between Nov. 18 and the Governor and Cabinet Meeting in mid-December but Clark indicated the university has a plan to provide bridge funding so construction can begin.

“We worked with the Division of Bond Financing to be able to offer athletics a bridge loan so they can start the project immediately,” Clark said, “right after the North Alabama game, because of the tight timeline.”

Clark said all the project approvals will be in place by then and there is a precedent for the University to provide bridge loans as they did with the Student Union and other campus projects. The university will be reimbursed from the bond proceeds.

The meeting ended with approval of a request for FSU to seek BOG approval at the Nov. 8-9 meeting to issue taxable and or tax-exempt bond financing through the Florida Division of Bond Finance for an amount not to exceed $265 million. FSU is also requesting approval for the university to be reimbursed for the combined Dunlap Football Ops Center and for the Doak Campbell Stadium improvement bond proceeds for capital expenditures to be paid by the university in conjunction with both projects.

“This was a great overview,” Chairman Henderson concluded. “This committee has had this presentation live in front of us before and we have done a deep dive looking at the feasibility of the revenue that would emanate from these changes, the quality of the advisors that the Boosters and the university has sought out to get a really-good picture of what goes forward. This information has been shared with us now a second time and it will be shared with the BOT a second time. I can’t imagine any more visibility with this committee or with the board leading up to the next step with the (BOT) and the BOG and the Governor.”

Follow The Osceola on Facebook

Follow The Osceola on Twitter

Subscribe to the Osceola's YouTube channel

Subscribe to the Osceola's podcasts on Apple

Subscribe to the Osceola's podcasts on Spotify